Thinking About Hiring a Wealth Advisor? Read This First

It's about whether they save you more than what you pay in fees.

I hired a wealth advisor recently. And looking back, I probably should have hired them sooner.

When I left my corporate job, I had a lot of important financial decisions to make.

I wanted to sell some stock, but I didn’t know what to sell or how to time the trade.

Furthermore, I needed advice on how to manage my cash flow during variable income months as an entrepreneur. I had never dealt with this before as a W-2 employee, which is why I considered hiring them over a year ago.

In my own wealth advisors’ words, if you have a question about money, they have an answer. They can help you manage your investments or advise on buying your first home. They even told me they helped one client audit their monthly grocery bills before.

So when I began my entrepreneurship journey, I definitely had a lot of questions about finances. But what stopped me from hiring them sooner were the management fees I’d have to pay for their services.

How Much Are the Management Fees?

Wealth management fees are usually 1% of assets under management up to the first million, and a declining percentage after that.

So for example if you had a million under management, you’d pay $10k in annual fees, split into four $2500 quarterly payments.

On the surface, this seems like a lot. But I’ve realized to NOT pay for this advice could cost even more.

My decision came down to one question:

Will a wealth advisor save me more money than the management fees I pay them?

My thinking is that if they help me:

avoid one bad trade

prevent one tax mistake

focus on my business instead of worrying about my savings

then the fees will pay for itself. Although I’ve only hired them for a month, and I’m still evaluating whether they’re worth it or not, I’m happy with my decision so far.

A Single Investment Mistake Costs More than 1%

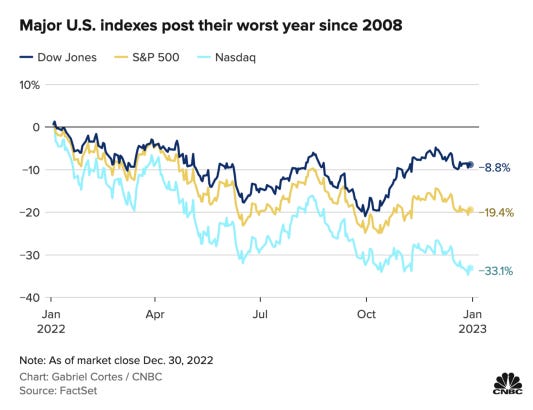

To say that 2022 was a bad year financially would be an understatement.

Crypto imploded, NASDAQ is down 33%, and even the high-flying FANG stocks took a beating. The biggest loser Meta shed 70% of its value.

And if you think this was bad, one person told me that they lost 90% of their net worth last year.

It’s clear that everyone is down more than 1%. So to me, if a wealth advisor can help avoid an extra one percentage loss, then it would’ve been worth it.

By helping me stay disciplined and avoid amateur mistakes like:

getting greedy

being indecisive

thinking that everything always goes up

I could’ve saved at least 1% more easily had I hired them sooner. In fact, it was my current advisors who told me a year ago that I should’ve considered:

selling certain tech stocks because they made up “too big of a percentage of my net worth”

that the last few years were in the “99th percentile” of stock market performances

It doesn’t take a genius to realize that the market can’t perform in the 99th percentile forever. It’s insight like this that I’m looking to get from a wealth advisor to cover the fees.

Why the Tax Savings Alone Are Worth It

The second reason why I hired a wealth advisor is because taxes are expensive.

For example in late December 2022, my advisor counseled me to sell my losing positions to off-set the capital gains taxes that I’d owe from other trades.

This advice on tax-loss harvesting alone from one meeting saved me enough in taxes to pay for almost all of the management fees for the year.

Furthermore, I’ve realized a hidden benefit of having a wealth advisor is access to their network, including the tax specialists they know.

For example, when I asked for advice on how to structure my business to minimize taxes, they referred me to a former IRS official with over 20 years experience in the government who now runs their own tax consultancy.

This is not someone you can find on Google, as their business is entirely through word of mouth.

I’ve realized that wealth advisors are often very well-connected people. So I believe that the value of these referrals alone can offset the fees.

Wealth Management Distracted Me From My Priorities

Lastly, managing money was a major distraction in 2022. I’ve realized that the real cost of managing my own money is the opportunity cost of what I could’ve spent that time on instead.

For example, if I used the energy I spent watching the stock market on getting just one extra consulting deal or producing more content, my life could be very different right now.

Lenny Rachitsky, the author of a successful PM newsletter once talked about the value of focus for creators when he said,

“I find that any time not spent creating high quality content is not time well spent over the long run. It’s all about valuable content.”

In fact in a podcast he said that he hired a financial advisor as well. I suspect he did so for the same reasons I’m realizing now.

But Can’t You Just Buy Index Funds?

Wealth management is not as simple as just buying index funds.

First off, index funds might work out in the long run, but my time horizon is much shorter.

So I have more immediate cash needs than someone with a W-2 job and who can afford to wait out these long drawdowns.

Second, I feel it’s dangerous to just put your head in the sand and ignore changing macroeconomic conditions.

For example, if you bought S&P 500 index funds in 2001, you would’ve had to wait 12 years till 2013 to just break even on them again.

So I feel the advice from a wealth advisor on how to manage my investments during times like this could help.

Third, buying index funds as a strategy makes sense, but execution matters too. And there are a lot of details to executing this strategy that aren’t obvious to me. To name a few:

Should I sell stocks to buy these index funds?

Which index funds should I buy?

And in which accounts should I put which index funds?

Frankly at this point in my life, I don’t feel comfortable googling “financial advice reddit” and entrusting my entire financial future to strangers on the internet. I’d rather hear professional advice instead.

Advice on Hiring Wealth Advisors

If you’re thinking about hiring a wealth advisor, my main recommendation is to shop around.

Why You Shouldn’t Settle for the First Wealth Advisor You see

Different wealth advisors have different philosophies, and you want to make sure that your advisor shares yours.

For example, some wealth advisors are so focused on wealth maximization that they lose sight of the fact that money is also meant to be spent as well.

Sure, they might help you get to 70 in the safest way possible. But to me there’s no point in saving up to be a millionaire at 70, just to spend my savings to stay alive on a ventilator for a few extra years.

I’m happy to retire with a million less if it means I lived a life with fewer regrets during my younger years instead.

So make sure to ask not only about how they will invest your money, but how they believe that you should spend your money as well!

Timing When You Hire a Wealth Advisor is Important

The best time to hire a wealth advisor is right before you have to make a major financial decision. Examples include:

exercising stock options

buying a house

or selling large portions of stock

This is because if they help you make the right decision immediately after hiring them, that alone will cover the management fees for the year.

And lastly, remember that you can fire them at any point. It’s not a marriage, so if you’re not happy, you can always pack your bags and go elsewhere.

Final Thoughts

If you’re thinking about hiring a wealth advisor, it ultimately comes down to whether or not they can save you more than what you pay them in management fees.

Although I’m still evaluating whether they’re worth it or not, I believe that if they help me avoid a single bad trade or tax mistake per year, and allow me to focus on my entrepreneurship goals, then the fees will pay for itself.

Disclaimer: This is not financial advice, and nobody incentivized me to write this in any way.

Whenever you're ready, there are 3 ways I can help you:

(***NEW***) I’m hiring engineers for a short-term engineering consulting deal that will last 4 months. In this role, you will be coding with guidance from a number of other senior engineering leaders including me.

This is a PAID position. If you’re interested, reply to this email.

“Beginner’s Guide to Medium in 60 minutes” - where I break down my entire writing process and show you how to grow your Medium following. - (Coming 1/15/23)

“How to Be an Engineer Influencer” - where I teach W-2 employees how to diversify their income streams by building an audience on social media.

Find me on social media here.

Great topic and helpful info Michael. Always a pleasure to get your perspective.