I Sold a Software Business for $20,000 on Acquire.com. Here’s What I Learned.

Lessons on how to value a company, perform due diligence, and form partnerships

📣 Announcements

I’m offering a $1000 bonus if you refer someone who needs a ChatGPT app built to All-In Consulting.

I will get a ChatBot in their hands in 1 month for $10k.

Have them mention your name, and I’ll reach out when the deal closes.

About a year ago I sold a business on Acquire.com.

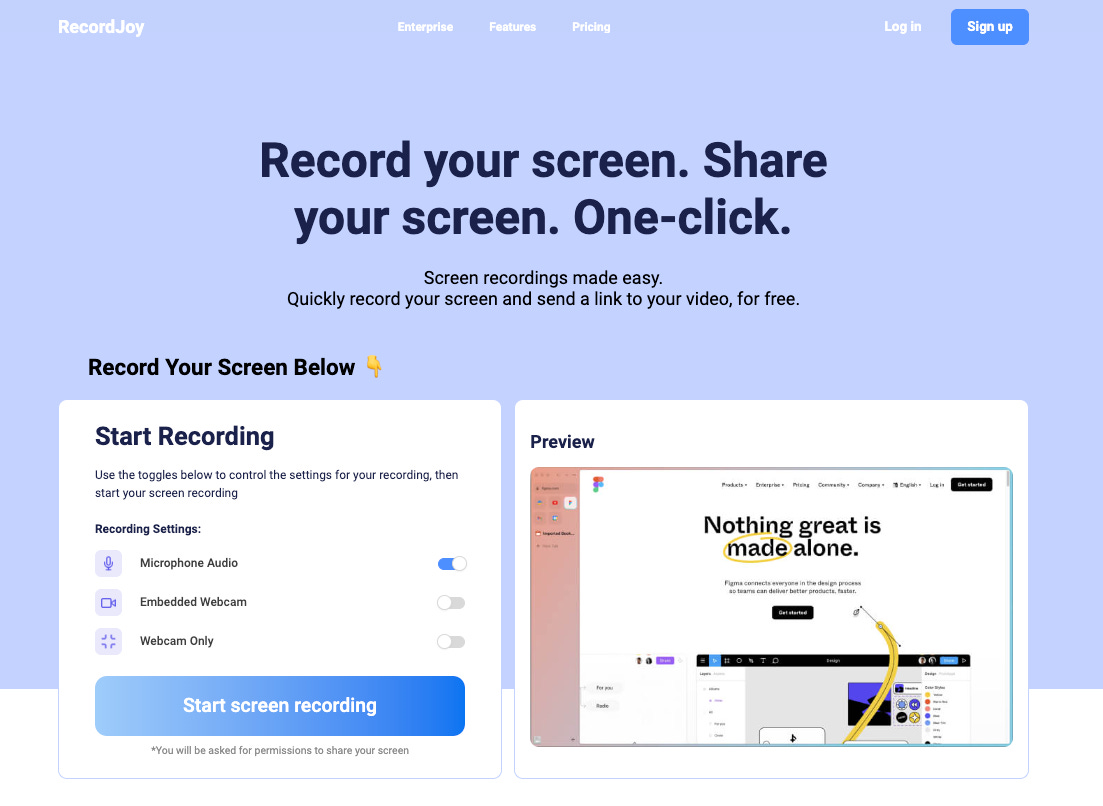

It was a one-click screen recording website called RecordJoy, and you can think of it as a poor man’s version of Loom.

After completing the sale, I did an interview for Acquire (previously known as Microacquire) to discuss my experience using their platform, and their CEO Andrew Gazdecki reshared the post last week.

So I wanted to share some of my learnings from the acquisition in this article.

How RecordJoy All Started

After I left Netflix in 2021 I didn’t have a plan, but I wanted to take advantage of my new-found freedom by traveling more.

I couldn’t go abroad because of COVID, so instead I lived in New York for a few months.

While there, I was afraid that I would get bored if I only traveled full-time, so I was looking for a side project I could work on.

About a week after I quit, my cousin Ben mentioned that he bought a “screen recording website” for $12k from Acquire as a side project. When I heard that, I saw that as a potential project that could be fun to hack on.

I suggested that we split ownership of the website 50/50 for $6k each and work on it together. We would split responsibilities such that he was the CTO in charge of product changes, while I was the CEO in charge of growth.

Together we could try and grow this business as co-founders.

He quickly agreed.

When we bought RecordJoy, it had no revenue and no way to take in payment info from customers. We rushed to add paid features to raise the value of the company as much as we could for 6 months.

Then Ben left to do an MBA, so we kept the site in maintenance-mode for another 6 months before selling it in April 2022.

How Much Did We Make From RecordJoy?

We sold RecordJoy for $20,000. We managed to get the product to about $700 MRR at the time of acquisition, and made a lifetime revenue of about $5k from the site.

Since we bought it for $12k, it was a modest acquisition given that I split it with my partner and had to cover some costs.

But looking back it was still worth doing. It helped with building credibility, getting press attention, and gaining followers.

I also now feel better equipped to handle another acquisition on both sides of the table after having sold RecordJoy.

Here are the 3 most important lessons I learned from this acquisition.

Lesson 1: Understanding How to Value a Company

The most important lesson from selling RecordJoy was learning how to properly value a company.

Most of the time, we value companies based on a multiple of revenue. For example, if a company makes 10k/year and we give it a 3x multiple, then the company is worth 30k.

However, for smaller companies this is actually a mistake because it doesn’t account for the value of the IP itself.

Especially at low revenues, the code and IP are worth far more than the revenue it generates.

So the proper way to value a company, especially if it doesn’t make that much money, is to follow this formula:

1️. Determine how much this company is worth if it made 0 revenue.

2️. Then add the revenue multiple on top of that answer.

And that’s the real value of the company.

For SaaS businesses like RecordJoy, the answer to number 1 would be to consider how much it would cost to build a website like RecordJoy from scratch.

For example, if building RecordJoy takes 100 developer hours, and you had to pay a developer $100/hour to build it, then that means that the IP alone is worth 100 hours * $100/hour = $10k.

Any extra revenue this product generates should be added on top of this base $10k value.

An exercise for you when you sell your first business is to consider the value of ALL of your company’s assets beyond just the revenue it generates. This includes:

The domain name

The email list

The SEO traffic

The brand

The relationships with distributors

The developer hours needed to build this from scratch

The value of the IP itself

These assets may be worth more than the revenue multiple itself!

Lesson 2: The Importance of Partnerships

The second lesson from RecordJoy came from a missed partnership opportunity that could’ve really skyrocketed RecordJoy’s growth.

One of our customers was an IT director who knew how much other IT companies needed our screen recording tool.

They wanted to acquire RecordJoy to sell it to other IT companies in their network, but they didn't have the coding experience needed to make the necessary code changes.

They ended up making an offer to buy RecordJoy, but we never closed on the deal with them because our desired prices were too far apart.

Looking back, we made a mistake in this deal by failing to discuss all the other options we had besides an acquisition.

Instead of selling the business to this buyer, we could’ve proposed taking them on as a business partner or co-founder instead.

That way the buyer could provide us with leads from their network, while we provide the engineering expertise to integrate the product for other IT companies.

This partnership could’ve been even more valuable than selling the business outright! 🤯

The lesson from this missed opportunity was that every person you meet is a potential business partner, so it’s always important to think about ways to combine your talents, interest, and assets with others in a mutually beneficial manner.

In this case it was the buyer’s network combined with our engineering expertise that could’ve created a lot of value. With someone else it could be a shared interest in a particular field that makes you suitable to be cofounders.

But both the buyer and I were so focused on the acquisition that we completely missed the option of working together.

When closing a deal with someone, always consider whether there are other deals you can make with them - it could be more valuable than the deal at hand!

And don’t forget that I’m also someone you can partner with! If you have mutually beneficial partnership opportunities, feel free to pitch me by replying to this email or messaging me on LinkedIn.

Let’s grow together!

Lesson 3: How to Perform Due Diligence

The last learning I had was how to perform proper due diligence on a company. Doing due diligence is more than just an audit. It’s the time to plan out what engineering changes you want to make while the other party’s engineering team is still there.

For example with RecordJoy, we knew the moment we bought it we would need to add paid subscriptions to the app. This meant that we had to create a plan tier page like below, and also add in a way for users to create an account so we knew who to bill.

During due diligence, we made sure our previous buyer walked us through how to add these features in. That way, within a week of buying, we were able to immediately push out paid features.

And we actually got our first paying customer just a few days after introducing these features.

So the lesson here is that before you buy a company, have a clear idea on how you plan to grow it before you buy it.

Whether this is from adding paid subscriptions, ads, or content marketing, you want to know your growth channels beforehand so you can consult with the previous engineering team on the fastest way to implement it so you come roaring out of the gate once the acquisition is complete.

Conclusion

I’ve paused building SaaS businesses like RecordJoy for now, which is why I moved into service-based businesses with All-In Consulting instead. But if you were ever looking for startup ideas, I recommend going to Acquire and browsing around for businesses being sold.

It is a rich source of inspiration for your entrepreneurial ventures!

And if you have a business that has been languishing around, I recommend trying to list it there too.

RecordJoy got 20 offers in 2 weeks and we closed the deal within a month of listing.

So you might be surprised by the offers you get if you list your product there too!

Whenever you're ready, there are 2 ways I can help you:

“Beginner’s Guide to Medium in 60 minutes” - where I break down my entire writing process and show you how to grow your Medium following.

“How to Be an Engineer Influencer” - where I teach W-2 employees how to diversify their income streams by building an audience on social media.

Connect with me on social media here.